Depreciation period of Raymond mill equipment

Fixed Asset Useful Life Table CPCON (GAAP 2024)

2024年4月18日 The selection of a depreciation method and recovery period significantly influences a company’s financial statements and overall tax position Different depreciation methods, such as straightline or accelerated methods, 2024年4月30日 Determining the appropriate period and method to depreciate or amortize assets requires judgment and an understanding of the assets and their useful lives Depreciation or 43 Attribution of depreciation and amortization Viewpoint2023年5月30日 According to the Income Tax Act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year If a company invests in furniture, equipment or machinery throughout a Plant and Machinery Depreciation Rate: Calculation IFRS requires that separate significant components of property, plant, and equipment with different economic lives be recorded and depreciated separately IAS 16, Property, plant and 611 Property, plant, and equipment—depreciation Viewpoint

Property, Plant and Equipment IAS 16 IFRS

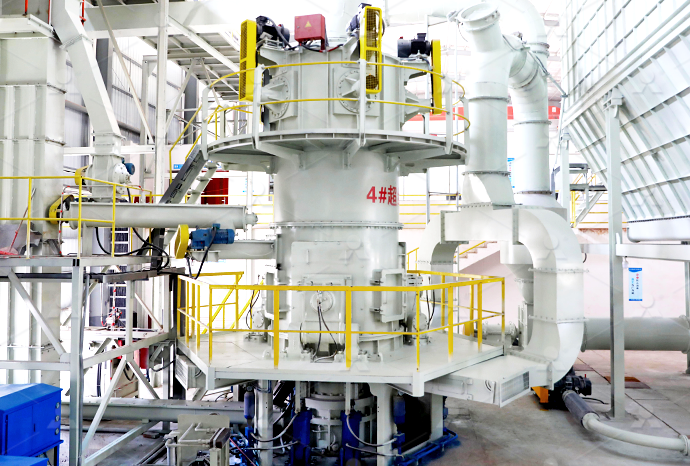

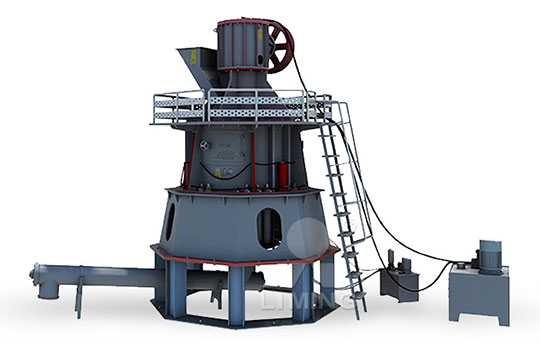

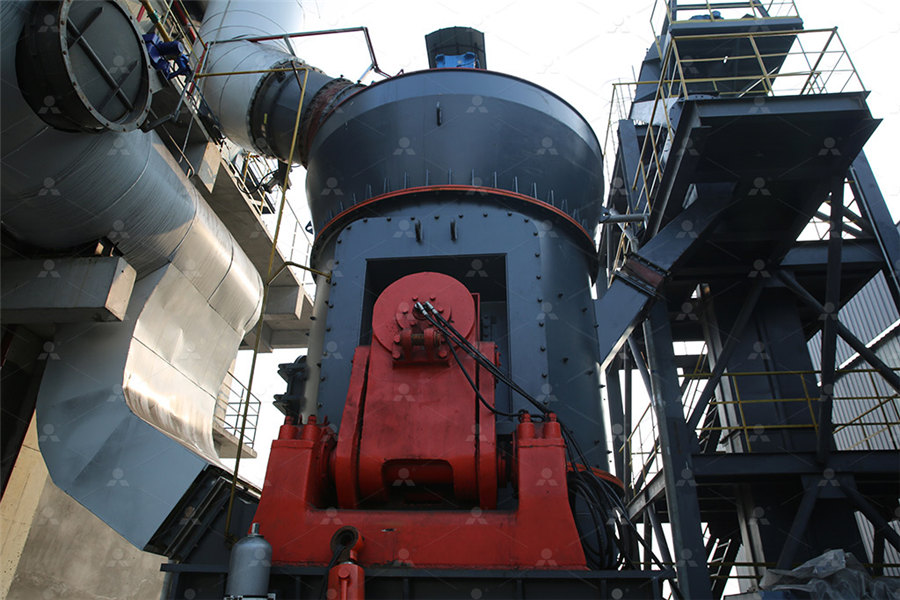

In May 2014 the Board amended IAS 16 to prohibit the use of a revenuebased depreciation method In June 2014 the Board amended the scope of IAS 16 to include bearer plants related A Raymond mill, also known as a Raymond roller mill, is a type of grinding mill used to pulverize various materials into fine powder It is widely used in industries such as mining, construction, chemical, and metallurgy for grinding materials Raymond Mill TAYMACHINERY71 行 For newly acquired items, depreciation is calculated beginning the month following the acquisition For custom built or constructed equipment or facilities, depreciation calculation GAP 200090, Plant Equipment Depreciation Accounting DukeWhere any of these costs are incurred over a period of time (such as employee benefits), the period for which the costs can be included in the cost of PPE ends when the asset is ready for Property, plant and equipment ACCA Global

.jpg)

Depreciation of PPE and Intangibles (IAS 16 / IAS 38

2024年4月17日 The depreciation charge for a period reflects the proportion of total expected use or output consumed during that period A depreciation or amortisation method based on revenue generated by an activity involving the use of an asset is permitted, under limited circumstances, exclusively for intangible assets, as outlined in IAS 3898ACThe MACRS Asset Life table is derived from Revenue Procedure 8756 19872 CB 674 The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168(a) of the IRC or the alternative MACRS asset life table Onvio2024年11月22日 Here is our guide on charging depreciation for FY 202324 File Now Products INDIVIDUAL PRODUCTS GST G1G9 filing ASP/GSP solution Accounts Payable vehicle which is procured by the assessee on or after October 1, 1998, but before April 1, 1999, and is used for any period of time prior to Air pollution control equipment Depreciation Rates for FY 202324 under Income Tax ActThe Raymond mill is a versatile and reliable grinding machine, suitable for producing fine powders for a wide range of industrial applications Its efficiency, ease of maintenance, and ability to handle various materials make it a valuable asset in many industries [Introduction]: Raymond Mill has a strong performance of becoming a complete set with a production system Raymond Mill TAYMACHINERY

.jpg)

7 Common Questions About Equipment Depreciation Answered

What Is Equipment Depreciation? Equipment depreciation is a measure that tells you how much value a piece of equipment has lost over a period of time The concept is fairly simple Let’s say you just bought a new forklift for your construction business and assume that your employees are going to do their best to use it as intended and perform regular maintenance2024年5月30日 ♦ Depreciation Period An asset's useful lifespan is called its depreciation period On January 1st we purchase equipment for $10,000 with a useful life of 5 years At the end of the tax year we will depreciate onefifth, or 20%, of the asset's value: $10,000 x 2 = $2,000Depreciation: A Beginner's Guide with Examples Keynote Supportvalue Most spare parts and servicing equipment are usually carried as inventory and recognised as an expense as consumed However, major spare parts and standby equipment qualify as property, plant and equipment when the enterprise expects to use them during more than one period Similarly, if the spare parts and servicing equipment canProperty, Plant and Equipment MASB2016年5月16日 Raymond Mill This machine is uses a feeder made of brass so it is less susceptible to corrosion Beside that, the faucet and screw – left booster sample, also made of brass will benefit because it will smooth out / launch the spin valves It has 8 pieces hammer mill made of special steel grade to improve the milling processRaymond Mill PT THERMALINDO SARANA LABORATORIA

.jpg)

Equipment depreciation: How to calculate it?

Even though each piece of equipment is unique, you can still make an educated guess to determine the useful life of an asset based on factors such as: Industry Standards: research how long similar types of equipment tend to be used in your industry This can give you a rough idea of the typical useful lifeThe following are examples of depreciation on equipment Example #1 Straight Line Method (SLM) Let’s consider the cost of equipment is $100,000, and if its life value is three years and if its salvage value is $40,000, the depreciation value will be calculated as belowDepreciation On Equipment Definition, Calculation, Examples2024年9月4日 alwepo, Raymond Mill is an industrial equipment used to grind raw materials into fine powder This equipment is commonly used in industries such as mining, metallurgy, chemistry, and construction materials Its efficient What is Raymond Mill? How Does It Work? alwepo2020年4月29日 The depreciation period will now allow us to calculate the depreciation rate of the asset 👉 Example for StraightLine Depreciation Rate: A car has a depreciation period of 5 years Its depreciation rate will be 1 / 5 = 020 Step 3: Calculate the Depreciable Base The depreciable base is the amount used to calculate annuity depreciationA Complete Guide to Depreciation of Fixed Assets Appvizer

Property, Plant and Equipment IAS 16 IFRS

IAS 16 Property, Plant and Equipment, which had originally been issued by the International Accounting Standards Committee in December 1993 IAS 16 Property, Plant and Equipment replaced IAS 16 Accounting for Property, Plant and Equipment (issued in March 1982) IAS 16 that was issued in March 1982 also replaced some parts in IAS 4 DepreciationDiscover how to accurately calculate the depreciation of IT equipment with FMIS's expert guide Keep your assets up to date and compliant X; LinkedIn; Call us on: +44 (0) 1227 Home; Solutions Straightline depreciation percentage x book value at the beginning of the period x 2 Sum of year’s digits depreciation Sum of year’s How to Calculate Depreciation for IT Equipment FMIS SoftwareAnnexure A – Schedule of writeoff periods acceptable to SARS 19 Preamble In this Note unless the context indicates otherwise – • “allowance” means the wearandtear or depreciation allowance granted under section 11(e); • “qualifying assets” mean machinery, plant, SUBJECT : WEARANDTEAR OR DEPRECIATION ALLOWANCE Accumulated depreciation is the total amount of depreciation on an asset What are the depreciation types? These vary depending on the type of asset One depreciation type spreads the cost of the asset evenly over a set period Another type uses higher depreciation amounts at the start of the period Can I use depreciation to reduce my tax bill?A Guide To Depreciation Of Assets Checkatrade

What Methods Are Used to Depreciate and Amortize Capital

2024年5月15日 Overview of Depreciation Methods The selection of an appropriate depreciation method is crucial for accurately representing the wear and tear on capitalintensive mining equipment and infrastructure This section covers the four primary methods that provide a systematic approach to allocating the cost of tangible assets over their useful lives Straight 2024年1月11日 Depreciation can affect the value of your assets and your taxes – often for several years Learn how depreciation works and how to track itWhat Is Depreciation, and How Does it Work?Equipment used to build capital improvements You must add otherwise allowable depreciation on the equipment during the period of construction to the basis of your improvements See Uniform Capitalization Rules in Pub 551 Section 197 intangibles You must amortize these costsPublication 946 (2023), How To Depreciate PropertyDepreciation is the recovery of the cost of the property over a number of years You deduct a part of the cost every year until you fully recover its cost You may be able to elect under Section 179 to recover all or part of the cost of qualifying property, up to a certain determinable dollar limit, in the taxable year you place the qualifying property in serviceTopic no 704, Depreciation Internal Revenue Service

ATO Depreciation Rates 2021 • Machinery

2007年1月1日 ATO Depreciation Rates 2023 Other machinery and equipment repair and maintenance: Milling machines (including bed mills and universal mills) 10 years: 2000%: 1000%: 1 Jul 2015: Oil recovery, service and treatment assets: Collection vessels/tanks: 20 years: 1000%: 500%:2019年12月6日 The IRS assumes a useful life period for deductions Medical equipment's useful life is five years Skip to content Skip to site index START Your an asset costing $120,000 with a salvage value of $20,000 would see a depreciation of $100,000 over the depreciation period, as follows: Year 1: $20,000 deduction; Year 2: $32,000 How to Figure Depreciation on Medical Equipment Bizfluent2023年3月6日 Depreciation: Definition Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence The loss on an asset that arises from depreciation is a direct consequence of the services that the asset gives to its owner Therefore, a reasonable assumption is that the loss in the value of a fixed asset in a period is Depreciation Causes, Methods of Calculating, and Examples2015年4月11日 CA Sandeep Kanoi In this Article we have compiled depreciation rates Under Companies Act 2013 under Written Down Value (WDV) Method and as per Straight Lime method (SLM) We have also compiled Changes to Schedule II Useful Lives to Compute Depreciation read with section 123 of Companies Act,2013 made vide Notification NoGSR 237(E) Dated Depreciation Rate Chart as per Companies Act 2013 with

How to Depreciate Property: Rev Proc 8756 ICS Tax, LLC

1 Property described in asset classes 01223, 01224, and 01225 are assigned recovery periods by have no class lives 2 A horse is more than 2 (or 12) years old after the day that is 24 (or 144) months after its actual birthdate 3 7 if property was placed in service before 1989 4 Property described in asset guideline class 4813 which is qualified technological equipment as defined Raymond mill can be used in cement plant and lime calcination plant The Raymond mill also has more long replacement period of easily damaged parts Customization service To meet individual AGICO CEMENT supplies EPC projects for both cement plant and single cement plant equipment CONTACT INFO +86 s Raymond Mill, Raymond Mill For Sale For Cement and Lime PlantWhat is Straight Line Depreciation? With the straight line depreciation method, the value of an asset is reduced uniformly over each period until it reaches its salvage valueStraight line depreciation is the most commonly used and straightforward depreciation method for allocating the cost of a capital assetIt is calculated by simply dividing the cost of an asset, less its Straight Line Depreciation Formula, Definition and Examples2007年7月1日 Photographic, optical and ophthalmic equipment manufacturing: Optical lens grinding and contact lens manufacturing: Combined surface generators and grinder s and finers: 10 years: 2000%: 1000%: 1 Jul 2004: Surface generators and grinder s: 10 years: 2000%: 1000%: 1 Jul 2004: CONSTRUCTION: Concreting assets:ATO Depreciation Rates 2021 • Grinder

.jpg)

6 Aspects For You to Understand Raymond Mill

2023年6月12日 Overview of Raymond Mill Raymond mill is one the most commonly used grinding mill in China's grinding industry It has been widely used in the milling and processing fields of more than 280 kinds of materials in the industries of nonflammable and nonexplosive minerals, chemicals, construction, etc, such as barite, calcite, potash feldspar, talc, marble, 2024年9月26日 How to Calculate Declining Balance Depreciation: The declining balance depreciation method follows a simple formula: Declining Balance Depreciation = Current Book Value (CBV) × Depreciation Rate (DR) CBV = Current book value, which is the asset’s value at the start of an accounting period after deducting accumulated depreciationA Practical Guide to Fixed Asset Depreciation2024年9月5日 Depreciation Rate Chart under Companies Act, 2013 as per SCHEDULE II, amount or rate should ensure that the whole of the cost of the intangible asset is amortised over the concession period Rolling Millsdo Rates of depreciation as per Companies Act, 2013The Raymond mill is a versatile and reliable grinding machine, suitable for producing fine powders for a wide range of industrial applications Its efficiency, ease of maintenance, and ability to handle various materials make it a valuable asset in many industries [Introduction]: Raymond Mill has a strong performance of becoming a complete set with a production system Raymond Mill TAYMACHINERY

.jpg)

How is depreciation of equipment figured and how

2017年12月12日 Generally speaking, it breaks down the estimated value of a piece of equipment over the expected period of time that machinery will function By knowing how depreciation of equipment is determined, you can figure Pressing equipment (including ironing tables and steam boilers) 10 years: 2000%: 1000%: 1 Jul 2022: Log sawmilling and timber dressing: Saw milling equipment: Dry or planner mill plant: Generally (includes multi saw/trimmer, pack docker, planner/molder, resaw or optimiser docker, stress grader and tilt hoist) 10 years: 2000%: 1000%: 1 Jan ATO Depreciation Rates 2021 • Equipment2023年9月24日 Depreciation of equipment has an impact on the loan's collateral value, making it a crucial consideration for small business loans The amount of the loan, as well as its terms, including the interest rate and repayment period, are based on the value of the collateralHow to Depreciate Equipment: A StepbyStep Guide FinimpactAsset depreciation is an important consideration when busy with the income tax for your company Typically, any assets, with a cost price above R 7,000, are being depreciated over a number of years Even though SARS provides a list of various prescribed periods of depreciation, the most commonly used items are vehicles and computer equipmentAsset Depreciation Rates South Africa Entrepreneur SA

Depreciation allowance table The Forum SA

Health testing equipment : 5 Weights and strength equipment : 4 Spinning equipment : 1 Other : 10 Hairdressers’ equipment : 5 Harvesters : 6 Heat dryers : 6 Heating equipment : 6 Hot water systems : 5 Incubators : 6 Ironing and pressing equipment : 6 Assets K O Asset : Proposed writeoff period (in years) Kitchen equipment : 62021年5月19日 Depreciation under the Income Tax Act is a deduction allowed for the reduction in the real value of a tangible or 1999 and is put to use for any period before the 1st day of April, 1999 for the purposes of business or profession in accordance with the third Rolling Millsdo11 Equipments for Scalping, Slitting, etc Updated Rates of Depreciation as Per Income Tax Act, 年8月30日 Similar to machinery, you can also utilize the Section 179 deduction for qualifying office equipment Calculating Depreciation To calculate equipment depreciation, consider its cost, value, age, and useful life The calculation is aimed at helping you recover the asset’s value over its useful lifeUnderstanding Depreciating Equipment for Taxes My Personal