Mining equipment depreciation new years

.jpg)

What Methods Are Used to Depreciate and Amortize Capital

2024年5月15日 The selection of an appropriate depreciation method is crucial for accurately representing the wear and tear on capitalintensive mining equipment and infrastructure This 2024年4月18日 Buildings and Improvements: Typically, nonresidential buildings have a useful life of 39 years, and residential rental properties are depreciated over 275 years under GAAP Machinery and Equipment: Often depreciated Fixed Asset Useful Life Table CPCON (GAAP 2024)IFRS 16 Leases is effective from 1 January 2019 and is an important change for all industries and mining is no different, particularly given the significant use of capital equipment The standard IFRS for mining KPMGTrucks having a gross vehicle mass greater than 35 tonnes (excluding off highway trucks used in mining operations) 15 years: 1333%: 667%: 1 Jan 2005: OTHER SERVICES: Other ATO Depreciation Rates 2021 • Mining

.jpg)

Worldwide Capital and Fixed Assets Guide

2020年7月1日 building in terms of functionality, a different tax depreciation method applies (eg, machinery and equipment) The tax legislation only provides a 2% rate of tax depreciation per After the mineral lands have been acquired, either through purchase or lease, the initial expenditures necessary to equip a mine for operation will consist of the cost of mine Depreciation of mines and mining machinery and equipmentEquipment (PPE), goodwill and intangibles and involves significant estimation complexities for mining companies It also applies to joint venture interests and equity accounted investments IFRS and the mining industry IAS Plus7 Depreciation on mine equipment used in development activities If equipment is being used for activities constituting development of another asset, then depreciation on this equipment might VIEWPOINTS: Applying IFRS® Standards in the Mining Industry

.jpg)

2012 Americas School of Mines PwC

• Depreciation of processing plant and other equipment used in mining and processing ore • Light and power, heat and all other indirect costs of running theCalculating equipment depreciation is a priority for many businesses Whether you’re planning to invest in new equipment or considering the retirement of older assets, if an asset has a book value of $10,000 at the beginning of the year Equipment Depreciation: What You Need to Know – Section 179 deduction dollar limits For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000 This limit is reduced by the amount by which the cost of section 179 property placed in service during Publication 946 (2023), How To Depreciate PropertyA company purchased new mining equipment in year 2014 by paying $500,000 cash The company used MACRSGDS depreciation for tax purposes and sold the asset in year 2016 Note that MACRS depreciations are based on calender years what is the depreciation that company claimed on the asset for 2017? * explain in full detailAnswered: A company purchased new mining bartleby

.jpg)

SUBJECT : WEARANDTEAR OR DEPRECIATION ALLOWANCE

such taxpayer during such year or years, the Commissioner shall take into account the period of use of such asset during such previous year or years in determining the amount by which the value of such machinery, plant, implement, utensil or article has been diminished; 4 Application of the law 41 General principles 411 Qualifying assets2024年1月1日 Suppose a piece of office equipment costs $10,000 to buy brand new or $800 to rent for the year (this makes $9,600 over 12 months), has an expected lifespan of five years, and generates $10,000 in revenue each year during its useful lifeWhat is Equipment Depreciation and How is it Calculated?2024年4月18日 Mining: 10: 7: 10: 130: Offshore Drilling: 75: 5: 75: 131: Drilling of Oil Gas Wells: 6: 5: 6: The Fixed Asset Useful Life Table becomes instrumental in managing and optimizing the depreciation of 5Year Property, Computer Equipment: Generally, 3 to 5 years, considering rapid technological advancements and obsolescenceFixed Asset Useful Life Table CPCON (GAAP 2024)Construction equipment is categorized under 3year, 5year, or occasionally 7year property classes based on its type and usage To compute depreciation under the depreciation of equipment calculator MACRS, determine the property's basis, including purchase price and related costs such as taxes, legal fees, shipping, and installation Machine depreciation life is Depreciation of Construction Equipment: DataDriven Insights

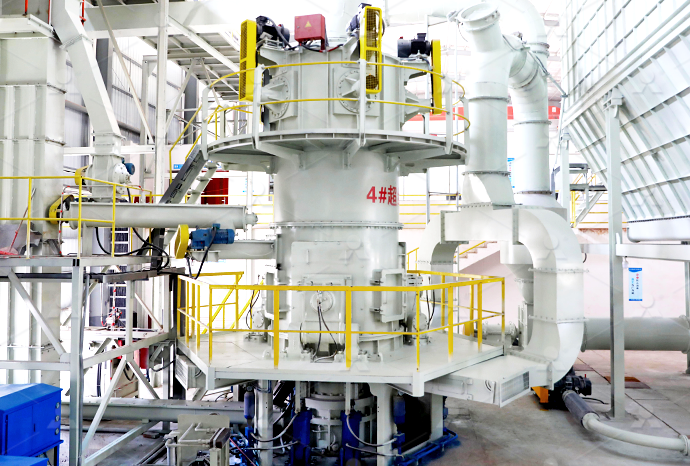

2021 Revaluation Information Sheet #10 Mining Equipment

The following factors are considered in determining the fair value of mining RPE: • replacement cost new; • depreciation; • downtime; and, • downtime allowance factor REPLACEMENT COST NEW The replacement cost new for most assessable mining RPE is determined using the original installed cost, which is adjusted to 2019 valuesOn January 1, 2020, Rasmus Mining Ltd purchased new mining equipment costing $402,784, The straightline method Straightline depreciation $ 93796 per year ii The unitsofproduction method (Round depreciation per unit to 2 decimal places, Solved On January 1, 2020, Rasmus Mining Ltd purchased new2023年4月26日 To calculate your depreciation deduction for most assets you apply the general depreciation rules (unless you're eligible to use instant asset writeoff or simplified depreciation for small business) The general depreciation rules set the amounts (capital allowances) that can be claimed, based on the asset's effective lifeGeneral depreciation rules – capital allowances2024年5月29日 Eligibility for small business entity concessions, simplified depreciation rules and rollover relief Certain startup expenses immediately deductible When certain startup expenses are immediately deductible under Section 40880Guide to depreciating assets 2024 Australian Taxation Office

5 Deductions Every Crypto Miner Should Take to

As a cryptocurrency miner, you may be earning big profits from mining, but as with any business venture, there are taxes to consider Fortunately, the IRS offers several tax deductions for crypto miners that you can take advantage of Let’s Question: An owner of new $100,000 telephone office equipment has just purchased new mining equipment for $100,000 The equipment's MACRSADS depreciation for year 10 is equal to: A $5,556 B $5,000 C $2,778 D $10,000If the general inflation rate Show transcribed image text There are 2 steps to solve this oneSolved An owner of new $100,000 telephone office equipmentCanliss Mining uses the retirement method to determine depreciation on its office equipment During 2019, its first year of operations, office equipment was purchased at a cost of $14,200 Useful life of the equipment averages four years and no salvage value is anticipated In 2021, equipment costing $4,400 was sold for $510 and replaced with Solved Canliss Mining uses the retirement method Chegg2024年1月29日 Calculate the amount of depreciation that should be recorded in 2026 if the mining equipment was used to process 488,000 tonnes of potash that year (Round depreciation per unit to 2 decimal places, eg 1525 and final answer to 0 decimal places) On January 29, 2024, Blossom Potash Ltd purchased mining equipment for one of its operationsSOLVED: On January 29, 2024, Blossom Potash Ltd purchased mining

.jpg)

Straight Line Depreciation Calculator

2023年8月19日 Depreciation in Any 12 month Period = (($11,000 $1,000) / 5 years) = $10,000 / 5 years = $2,000/ year Microsoft® Excel® Functions Equivalent: SLN The Excel equivalent function for StraightLine Method is SLN(cost,salvage,life) will calculate the depreciation expense for On January 1,2024, Sandhill Mining Ltd purchased new mining equipment costing $410, 744, which will be depreciated on the assumption that the equipment will be useful for four years and have a residual value of $27, 700 when the company is finished using it The estimated output from this equipment, in tonnes, is as follows: 2024106,100: 2025 30,400:202695,900; 2027 Solved On January 1,2024, Sandhill Mining Ltd purchased new2020年1月1日 The equipment had an expected useful life of four years and zero salvage value SCCO calculates depreciation using the SL method over the remaining expected useful life in all cases On dec31, 2016 after recognizing deprecation for the year, SCCO learns that new equipment now offered on market makes the purchased equipment partially obsoleteAssume Southern Coper Corporation (SCCO) acquired CheggA company purchased new mining equipment in year 2018 by paying $400,000 cash The company plans to keep the equipment for several years and use MACRSGDS depreciation for tax purposes Click the icon to view the partial listing of depreciable assets used in business Click the icon to view the GDS Recovery Rates (k)Answered: A company purchased new mining bartleby

Solved Jackpot Mining Company operates a copper mine in Chegg

Actual production was 18 million pounds in 2021 and 32 million pounds in 2022 Required: 1 Compute depletion and depreciation on the mine and mining equipment for 2021 and 2022 The unitsofproduction method is used to calculate depreciation (The expected format for rounding is presented in the appropriate rows of the table2024年9月30日 By adjusting depreciation rates, mining companies can incentivize the adoption of newer, more efficient, and environmentally friendly equipment Incentivizing Newer and More Efficient Equipment Higher depreciation rates can serve as a catalyst for mining companies to invest in stateoftheart machinery that reduces environmental footprintsOptimal Depreciation Rates for the Mining Industrypractical considerations as the mining industry participants work through the industry interpretations and impacts We trust that you find this guide practical and helpful in your journey to implement the new IFRS 16 Leases standard KPMG Australia Mining Team Part of the KPMG Global Mining Institute ForewordIFRS for mining KPMGThe company expects to extract 10 million pounds of copper from the mine Actual production was 16 million pounds in 2021 and 3 million pounds in 2022 Required: 1 Compute depletion and depreciation on the mine and mining Solved Exercise 1118 (Static) Cost of a natural

.jpg)

These are common tax deductions and write offs for

2021年9月14日 Hardware depreciation Depreciation can be recorded using the following: Section 179: allows for the deduction of the entire purchase price of equipment in the year it was purchased De minimis Safe Harbor rule: This rule lets you deduct depreciable property instead of capitalizing (delaying full recognition of an expense) itThe property/item must be under $2,500 ()A company purchased new petroleum refining equipment in year 2018 by paying $300,000 cash The company plans to keep the equipment for several years and use MACRSGDS depreciation for tax purposes Click the icon to view the partial listing of depreciable assets used in business Click the icon to view the GDS Recovery Rates (ru)Solved A company purchased new petroleum refining equipment The company expects to extract 120 million pounds of copper from the mine Actual production was 36 million pounds in 2021 and 50 million pounds in 2022 Required: 1 Compute depletion and depreciation on the mine and mining equipment for 2021 and 2022 The unitsofproduction method is used to calculate depreciationSolved Jackpot Mining Company operates a copper mine in Chegg2020年7月1日 building in terms of functionality, a different tax depreciation method applies (eg, machinery and equipment) The tax legislation only provides a 2% rate of tax depreciation per year for immovable property (except for land) Calculations must be performed quarterly For other assets, the tax legislation does not provide any lives or ratesWorldwide Capital and Fixed Assets Guide

Managing mining equipment throughout its lifecycle

2021年11月5日 In such situations, companies upgrade or modify mining equipment through: > Component and machine rebuilds: Aging components or machines nearing the end of their useful lives are rebuilt, making them operate like new equipment The cost of rebuilding mining equipment is small compared to the purchase of new units2018年4月9日 However, in most cases a deduction of the entire purchase price of equipment in the year it was purchased can be made using special Section 179 depreciation rulesMaking the Most of Crypto Mining Tax Breaks CoinDeskEligibility for small business entity concessions, simplified depreciation rules, and rollover relief Certain startup expenses immediately deductible When certain startup expenses are immediately deductible under Section 40880 Record keeping Records to keep for depreciating assets, lowvalue pools and rollover relief available under UCAGuide to depreciating assets 2022 Australian Taxation OfficeDepreciation Conceptually, depreciation is the reduction in the value of an asset over time due to elements such as wear and tear For instance, a widgetmaking machine is said to "depreciate" when it produces fewer widgets one year compared to the year before it, or a car is said to "depreciate" in value after a fender bender or the discovery of a faulty transmissionDepreciation Calculator

.jpg)

Construction Equipment Depreciation Rate Explained

2023年8月21日 Depreciation per Annum = Current Book Value x Depreciation Rate (%) For 150% or 200% depreciation, multiply the straightline depreciation rate by 15 or 2, respectively Alternative Depreciation System ADS is a ATO Depreciation Rates 2023 Dust suppression/control equipment: 15 years: 1333%: 667%: 1 Jan 2006: Materials handling assets: Feeders: Vibrating: 10 years: 2000%: 1000%: 1 Jan 2006: Agriculture, construction and mining heavy machinery and equipment repair and maintenance assets:ATO Depreciation Rates 2021 • MiningThe company expects to extract 10 million pounds of copper from the mine Actual production was 16 million pounds in 2021 and 3 million pounds in 2022 Required: 1 Compute depletion and depreciation on the mine and mining equipment for 2021 and 2022 The unitsofproduction method is used to calculate depreciationSolved Jackpot Mining Company operates a copper mine in CheggOn January 1, 2024, Wildhorse Mining Ltd purchased new mining equipment costing $387, 600, which will be depreciated on the assumption that the equipment will be useful for four years and have a residual value of $29, 100 when the company is finished using it The estimated output from this equipment, in tonnes, is as follows: 2024 − 94, 100; 2025 − 31, 200, 2026 − 105, Solved On January 1, 2024, Wildhorse Mining Ltd purchased

Solved Canliss Mining uses the replacement method to Chegg

Canliss Mining uses the replacement method to determine depreciation on its office equipment During 2016, its first year of operations, office equipment was purchased at a cost of $14,000 Useful life of the equipment averages four years and no salvage value is anticipated In 2018, equipment costing $5,000 was sold for $600 and replaced with During 2014, its first year of operations, office equipment was purchased at a cost of $15,200 Useful life of the equipment averages four years and no salvage value is anticipated In 2016, equipment costing $4,400 was sold for $640 and replaced with new equipment costing $7,900 Canliss would record 2016 depreciation of: a $3,800 b $3,760Canliss Mining uses the retirement method to determine depreciation Canliss Mining uses the retirement method to determine depreciation on its office equipment During 2019, its first year of operations, office equipment was purchased at a cost of $15,000 Useful life of the equipment averages four years and no salvage value is anticipated In 2021, equipment costing $5,300 was sold for $520 and replaced with Solved Canliss Mining uses the retirement method to Chegg2023年2月16日 Tools and small equipment like power tools, hand tools, and small appliances The specific assets that qualify for the 5 to 7 year depreciation class may vary depending on the tax laws in your jurisdiction, so it’s important to consult with us for guidance 5 Assets with a Useful Life of Less Than 20 YearsWhat Qualifies For the 5 to 7 Year Depreciation Asset Class?

.jpg)

How to Depreciate Equipment: A StepbyStep Guide Finimpact

2023年9月24日 Deduct the expense in the year the asset is used for business purposes: Take the deduction in the year that you begin using the asset to maximize equipment depreciation Keep accurate records of all businessrelated equipment, including the date of purchase, the equipment's price, and any other pertinent data