How to handle the accounting when buying sand when installing equipment in a mine

.jpg)

Financial reporting in the mining industry International Financial

how IFRS is applied in practice by mining companies This publication identifies the issues that are unique to the mining industry and includes a number of real life examples to demonstrate 2018年11月8日 It’s a virtual primer on how aggregate mining affects rivers, infrastructure, the water table, people and the environment The study argues that many of the impacts of sand and gravel mining are never reflected in the cost Why We Need FullCost Accounting for Aggregate accounting for property, plant and equipment are the recognition of the assets, the determination of their carrying amounts and the depreciation charges and impairment losses to be Property, Plant and Equipment IAS 16 IFRSAs outlined in the first two articles, the four key areas when accounting for PPE that you must ensure that you are familiar with are: One of the easiest ways to remember what should be Property, plant and equipment ACCA Global

Procurement Accounting 101: Key Concepts and Practices

In simple terms, procurement accounting bridges the gap between procurement, the process of sourcing and acquiring goods and services, and accounting, the financial aspect of those The accounting for IAS 16, Property, Plant and Equipment is a particularly important area of the Paper F7 syllabus You can almost guarantee that in every exam you will be required to 01 technIcAl accounting for property, plant and equipmentAssets are recorded on the balance sheet at cost, meaning that all costs to purchase the asset and to prepare the asset for operation should be included Costs outside of the purchase price 37 Recording the Initial Purchase of an Asset UnizinWhen a company acquires a plant asset, accountants record the asset at the cost of acquisition (historical cost) When a plant asset is purchased for cash, its acquisition cost is simply the 112: Entries for Cash and LumpSum Purchases of Property, Plant

Does the accrual method apply to the purchase of

To illustrate, let’s assume that on December 29 a company ordered and received some equipment to be used in its operations The payment for the equipment is to be made on February 10 Under the accrual method, on December 29 the Marilyn illustrates for Joe a second transaction On December 2, Direct Delivery purchases a used delivery van for $14,000 by writing a check for $14,000 The two accounts involved are Cash and Vehicles (or Delivery Equipment) When the check is written, the accounting software will automatically make the entry into these two accountsAccounting Basics Purchase of Assets AccountingCoach2021年6月24日 Examples of fixed assets include land, buildings, machinery, some office equipment Fixed assets cannot easily convert into cash For instance, stocks, bonds, and other longterm investments do not qualify as How to Record the Purchase of A Fixed How to record the purchase of a capital asset when using cash basis accounting This article explains how to record the purchase of a capital asset that your business buys if you’re preparing your accounts using cash basis accounting When using cash basis accounting, most asset purchases should be deducted as a business cost rather than as a capital allowanceHow to record the purchase of a capital asset when using

.jpg)

Booking Fixed Asset Journal Entry [With Examples]

2024年4月10日 Follow Accounting Principles: Adhere to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) when recording fixed asset transactions Use DoubleEntry System: Ensure that every transaction is recorded using the doubleentry system, where debits must equal credits to maintain balance2023年6月20日 Step 2: Decide on the amount and buy SAND To buy SAND with your chosen fiat currency, navigate to the “Buy Crypto” section on BYDFi’s homepage Note that fiat deposits are handled by thirdparty service providers and are not directly processed by BYDFi Buy crypto Source: bydfiHow to Buy The Sandbox (SAND) in 2 Minutes StepbyStep2024年8月21日 Accounting Basics If you’re an aspiring entrepreneur, running a small business, or just want to learn accounting basics in general, here’s an overview It starts with this conceptual understanding: accounting is to financial management what a foundation is to a building Accounting helps you keep track of three important things:Accounting 101: Accounting Basics for Beginners to LearnPart 3: Summary and detailed examples This is the final article in the series of three which consider the accounting for property, plant and equipment by applying IAS ® 16, Property, Plant and EquipmentThis is a particularly important area of the Financial Reporting (FR) syllabus and is also important assumed knowledge for the Strategic Business Reporting (SBR) examProperty, plant and equipment ACCA Global

Accounting For Purchases Explanation Examples And Recognition

As purchase results in increase in the expense and decrease in assets of the entity, expense must be debited while assets must be credited A purchase also results in increase in inventory, however the accounting for inventory is kept separate from accounting for purchase as will be further discussed in the inventory accounting section A purchase may be made on Cash or on In accrualbased accounting, services are posted when they take place, so deposits and partial payments have to be posted when they occur Recording a Received Deposit More For YouHow to Report Deposits in Accrual Based Accounting ChronAs a business owner or manager, you’re always looking for ways to cut costs and improve your bottom line One area where you can make a significant impact is in accounting for repairs and maintenance expenses By taking a closer look at how you account for this type of expenditure, you can save money and keep your finances healthyStep by Step on How to Account for Repairs and CPA Journal2024年5月29日 Properly accounting for these transactions ensures transparency, accuracy, and compliance with regulatory standards Given the complexities involved, understanding how to record land acquisitions, value land assets, and report any changes is crucial for stakeholders Accounting for Land AcquisitionAccounting for Land Transactions and Financial Reporting

.jpg)

Comprehensive Guide to Purchase Accounting Practices

2024年5月21日 Master the essentials of purchase accounting with our indepth guide, covering key elements, types, and advanced techniques for effective financial management Home; For example, a company purchasing a piece of manufacturing equipment for $100,000 may depreciate it over ten years, recognizing $10,000 in depreciation expense annually2021年8月23日 Let me help you handle equipment purchases in QuickBooks Desktop (QBDT) For manual tracking of equipment purchase, you can create an Asset Account for the equipment Here's how: Go to Lists and choose Chart of Accounts Click the Account button below and select New Choose Asset account as the account type Click ContinueHow to report an equipment purchase QuickBooks2024年6月13日 Once the inventoried items are sold in a later period, the equipment repair cost allocated to them will be charged to expense Capitalize the cost In a few rare cases, a repair will prolong the useful life of factory equipment If so, capitalize the cost of the repair and depreciate it over the life of the equipmentHow to account for repairs to factory equipment — AccountingTools2021年8月27日 My first thought was to enter the cost of the machine as a depreciation item under Furniture Equipment/Fixed Assets Recently, I was speaking to someone (bookkeeper, not an accountant) who suggested I simply take it as a regular expense under supplies Her reasoning was, it is not equipment used in the operation of our organizationSolved: When to report a purchase under Furniture Equipment

What Are The Steps For Equipment Installation?

Equipment Installation and Commissioning The installation and commissioning step is the final phase in the equipment installation process This phase includes physically installing equipment at the job site, commissioning equipment to ensure proper operation, and training personnel on the appropriate use and maintenance of the equipment2022年11月1日 Accounting for startup costs is fairly straightforward All startup costs are treated the same way for accounting You will likely lump all startup costs together into the same category You won’t break the costs down into smaller categories Record business startup costs when you incur them This is typical for accrual accountingAccounting for Startup Costs: How to Track Your Expenses2024年3月12日 Handling foreign currency transactions in bookkeeping is a critical skill for businesses operating in the global marketplace Bookkeepers must accurately track and report these transactions to maintain compliant financial records When dealing with foreign currencies, the complexity arises from fluctuations in exchange rates, recognizing gains and losses, and How to Handle Foreign Currency Transactions in Bookkeeping: 2019年6月26日 Overview Webinars, podcasts, articles, and blog posts keep you up to date; Articles Read articles written by our team of subject matter experts; Blog Insights from the team on the GRF blog; Case Studies Learn how GRF’s work impacts our clients; Events Proud to host and participate in a variety of events; Industry Alerts Developments that could affect your How to Structure a Business Asset Purchase with Taxes in Mind

.jpg)

How is Property, Plant, and Equipment (PPE) Recorded in Accounting?

Recording and managing Property, Plant, and Equipment (PPE) in accounting is crucial for accurate financial reporting and ensuring compliance with established accounting standards From acquisition to disposal, each step involves thoughtful calculation and attention to detail, whether it be in calculating depreciation, recognizing impairment, or revaluing assets2018年12月17日 FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland deals with property, plant and equipment in Section 17 Property, Plant and Equipment The term ‘property, plant and equipment’ is FRS 102 : property, plant and equipment and 2021年4月26日 The levying of taxes on office equipment is dependent on the government taxation rules in the country where the company does business Office equipment can be taxed in the following 2 ways: When office equipment Understanding Office Equipment In Accounting Tax2023年1月17日 This article will explore the intersection of fixed asset accounting and accounting for leases under ASC 842, largely focusing on accounting for finance (capital) leases with purchase optionsA full example on how to account for leasetoown transactions is included as well Other overlaps discussed throughout the article include capitalization, leasehold Lease Purchase Options: Fixed Assets Lease Accounting

The Cost of Property, Plant, Equipment CliffsNotes

Equipment, vehicles, and furniture The cost of equipment, vehicles, and furniture includes the purchase price, sales taxes, transportation fees, insurance paid to cover the item during shipment, assembly, installation, and all other costs associated with making the item ready for use2024年10月12日 Prepayment, accounting by the buyer For example, a company pays $12,000 in advance for Internet advertising that will extend through a full year The company initially charges the entire amount to the prepaid expenses account, and then charges $1,000 of it to the advertising expense account in each subsequent month, to reflect its usage of the expenditureHow to account for prepayments — AccountingTools2018年11月8日 "equipment of $10,000, furniture of $15,000, and goodwill of $15,000" Those are all Debits to various asset accounts Equipment and Furniture is Fixed Assets Goodwill is Other Asset The total Credit is Equity or the Bank payment How do I record the purchase of an existing business in QBO if I 2024年5月6日 Beach sand often contains salt, which can cause corrosion if not properly taken care of Rinse the sand thoroughly with fresh water and allow it to dry completely before placing it in a storage container Play sand, commonly used in sandboxes or for children’s activities, is usually clean and free of contaminantsHow To Store Sand Storables

36.jpg)

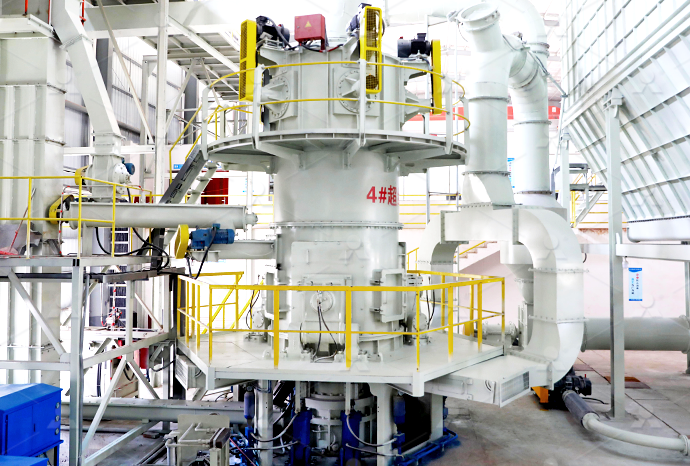

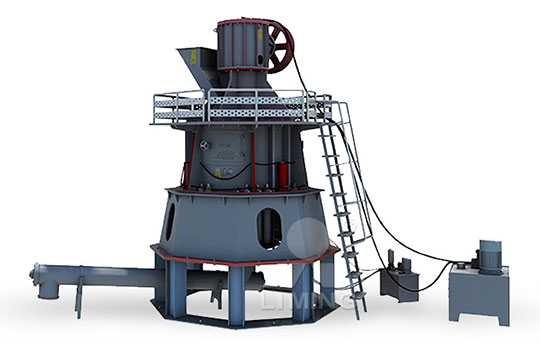

11 Considerations When Buying Mining Equipment

2019年6月20日 Choosing mining equipment with parts designed specifically for your operation and with exceptional ratings is the best way to get returns on your investment 8 Moisture and Humidity Heavy duty, weather resistant equipment is still necessary to extract, transport, and process minerals, ores, and precious metals from soil, sand, and rock2021年7月6日 Not to mention, it can be a good option if you need equipment quickly and don’t want to pay for expensive equipment Buying equipment On the other hand, when you buy equipment, you own it Although it can be appealing to own the business equipment yourself, it can be expensive to purchase it outrightLeasing vs Buying Equipment Pros, Cons, Considerations2021年6月29日 That's where this stepbystep buyer's guide for the software purchase process can help By completing each of these steps, you'll be able to create a strong procurement plan and make an informed purchasing decision Stepbystep guide to the software purchasing process Total monthly payment = $ 200 * 36 months = $ 7,200 Interest = (3,000 + 7,200) – 10,000 = $ 200 Accounting for Hire Purchase Hire purchase is the asset financing that allows the company to use the assets over a period of time in exchange for the installmentAccounting for Hire Purchase Journal Entry Example

The proper classification of fixed assets — AccountingTools

2024年8月11日 When to Classify an Asset as a Fixed Asset When assets are acquired, they should be recorded as fixed assets if they meet the following two criteria: Have a useful life of greater than one year; and Exceeds the corporate capitalization limit The capitalization limit is the amount of expenditure below which an item is recorded as an expense, rather than an asset2024年10月30日 Read our comprehensive, stepbystep guide on how to start a business We'll walk you through everything you need to know to increase your odds of successHow To Start A Business In 11 Steps (2024 Guide) ForbesEquipment replaced IAS 16 Accounting for Property, Plant and Equipment (issued in March 1982) IAS 16 that was issued in March 1982 also replaced some parts in IAS 4 Depreciation Accounting that was approved in November 1975 In December 2003 the Board issued a revised IAS 16 as part of its initial agenda ofProperty, Plant and Equipment IAS 16 IFRSIn reporting property and equipment, the asset does not physically shrink As the utility is consumed over time, buildings and equipment do not get smaller; they only get older To reflect that reality, a separate accumulated depreciation account 1 is created to measure the total amount of the asset’s cost that has been expensed to date101 The Reporting of Property and Equipment – Financial Accounting

Accounting for Repair and Maintenance Journal Entry

ABC is a consulting company that provides accounting services to other entities During the month of November, the company spends $ 5,000 on the various expense which includes: Taxi for staffs $ 200; Utilities expense $ 2,000; Repair window office $ 800; Change company tire $ 100;2021年9月24日 ASC 842, in continuity with the legacy FASB lease accounting standard, ASC 840, continues to require lessees to evaluate leases for appropriate classification between operating and capital (designated as “finance” under ASC 842) In practice, equipment leases, which can encompass vehicles, forklifts, copiers, and other various types of equipment may Equipment Lease Accounting Benefits of Leasing Equipment vs BuyingAccounting Methods for Options to Buy Land If you buy a $5,000 piece of manufacturing equipment, you debit $5,000 to your Fixed Asset account and credit the same amount to CashAccounting for an Asset Purchase Chron2023年7月17日 Such an accounting treatment helps to bring out the true financial position of a business Accounting for Equipment Lease – Steps Usually, the accounting for an equipment lease involves four activities in the lessee’s books Detailed below are the accounting treatments for all four activities: Initial EntryAccounting for Equipment Lease – Meaning, Treatment, and