Do industrial grinding machine manufacturers need to pay income tax

.jpg)

Expert Guide: Tax Planning for Manufacturers Manay CPA

2023年9月13日 Manufacturing businesses are subject to various types of taxes at the federal, state, and local levels, depending on their size, location, activities, and income Some of the While US manufacturers don’t pay sales tax on raw materials used in a final product, they may be responsible for the indirect taxes on purchases of equipment and supplies such as 6 questions for manufacturers to reduce sales tax overpaymentsAs an alternative, many states allow manufacturers to use “Direct Pay Permits” to allow a manufacturer to make purchases without paying sales tax When a part purchased using a Sales tax and use tax for manufacturers and distributors Avalara, The five common hot spots where sales tax exemptions are frequently inapplicable include: Maintenance Items; Production Supplies; Storage; Safety Apparel; Janitorial Supplies; Five Hot Spots for Manufacturing Sales Tax Exemptions

.jpg)

Indirect tax management for the manufacturing industry KPMG

Thomson Reuters’ ONESOURCE Indirect Tax technology can help Industrial Manufacturing companies manage, calculate, and report global indirect taxes, while helping to ensure 2024年5月8日 The Taxation Laws (Amendment) Ordinance, 2019 passed on 20 September 2019 has inserted Section 115BAB offering a low tax rate of 15% (plus surcharge and cess) to Section 115BAB Corporate Tax Rate for New Manufacturing 2019年8月13日 Raw materials and manufacturing machinery and equipment are tax exempt in Florida In contrast, tools such as grinding wheels and saw blades are taxable, as are Sales Tax for Manufacturers PMBA2019年1月16日 While most states correctly exempt manufacturing machinery from their sales tax, notable exceptions exist in Alabama, Hawaii, Kentucky, Mississippi, Nevada, New Mexico, Does Your State Tax Manufacturing Machinery?

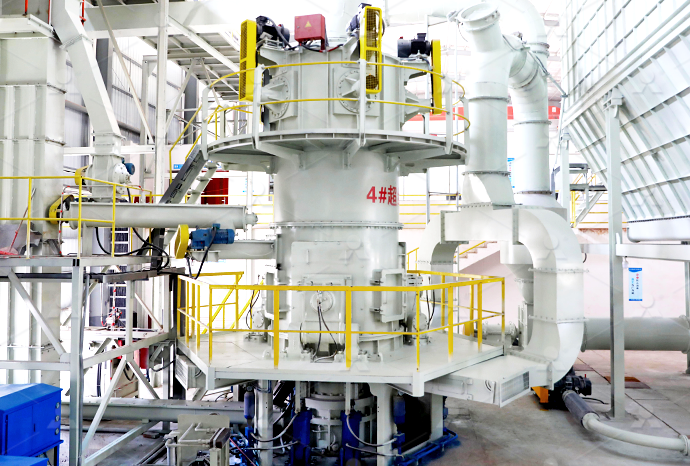

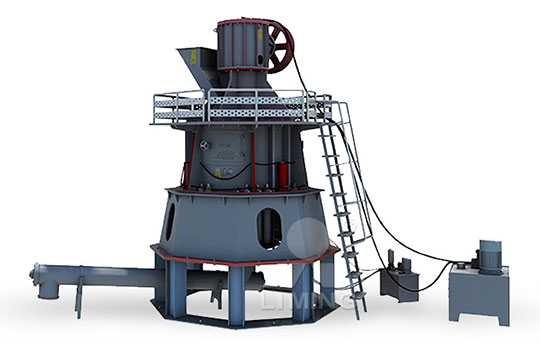

Industrial Grinding Machine Manufacturers, Suppliers, Dealers

This industrial device is essential for grinding and cutting tasks of specific types like surface grinding, cylindrical grinding, and cutter grinding Manufacturing Process In various manufacturing processes, grinding machines are used to improve the accuracy and performance of highquality components of various productsIf your state has a 5% tax on vending machine sales, you would need to pay $15000 in taxes for the month based on the 5% tax on $3,00000 in total vending machine sales for candy As you can see, the amount of taxes you’ll need to Do You Have To Pay Taxes On Vending Machine Sales?2022年10月19日 Details on how California sales tax applies to manufacturers, including paying sales tax on purchased materials and available exemptions Skip to Content Call Us Today! 8664587966California Sales Tax for Manufacturers and ProducersWhen divergent use occurs, the manufacturer must maintain supporting documentation reflecting the exempt and nonexempt use to selfassess tax each month or other filing period If divergent use during a month is 5 percent or less of the total use of the equipment, no tax is due in that month After four years, there is no tax on divergent useManufacturing Exemptions Texas Comptroller of Public Accounts

Michigan Sales Tax Exemption for Manufacturing

2020年11月16日 Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing Michigan defines industrial processing as “the activity of converting or conditioning tangible personal property by changing the form, composition, quality, combination or character of property for ultimate sale at retail or for use in the manufacturing 2019年11月20日 As part of an effort to create a more businessfriendly corporate tax environment, the Wisconsin sales tax exemption for manufacturing allows qualifying manufacturers to claim an exemption on a wide variety of operating purchases Wis Stat 7754(6)(am)(1) provides a sales tax exemption for “machines and The post Wisconsin Wisconsin Sales Tax Exemption for Manufacturing AgileThe death of a loved one comes with not only emotional pain but also a financial burden to the ones left behind through the estate tax For example, if you’re a legal heir or beneficiary of a deceased person, you’re required to pay the 6% estate tax based on the value of your inheritance (including money and properties) less allowable deductions before it’s transferred to your nameAn Ultimate Guide to Philippine Tax: Types, Computations, and 2017年8月9日 Sales and Use Tax TAA 17A013 Manufacturing Exemptions Question: Taxpayer is in seeking a determination whether the parts and repairs referenced below are exempt from Floridasales and use tax under the provisions of s 21208(7)(XX), fS, pertaining to the repair of qualifying industrial machinery and equipment Answers: Taxpayer is a qualifying Sales and Use Tax TAA 17A013 Manufacturing Exemptions

Sales Tax Frequently Asked Questions DOR

How much sales tax do I pay when I buy a vehicle? The sales tax rate is 5% and is based on the net purchase price of your vehicle (price after dealer’s discounts and tradeins) The 5% rate applies to cars, vans, buses and other private carriers of passengers and truck with a gross vehicle weight of 10,000 pounds or lessPersonal Allowance, Income Tax rates, bands and thresholds The standard Personal Allowance is £12,570, which is the amount of income you do not have to pay tax onIncome Tax rates and Personal Allowances GOVUKPennsylvania sales tax exemptions for manufacturing offer both manufacturers and processors an exemption on purchases of tangible personal property, including machinery and equipment, predominantly used directly in PA Sales Tax Exemptions for Manufacturing Agile 2024年8月14日 Who must file Most US citizens or permanent residents who work in the US have to file a tax return Generally, you need to file if: Your income is over the filing requirement; You have over $400 in net earnings from selfemployment (side jobs or other independent work); You had other situations that require you to file; It might pay you to file even if you don’t have toCheck if you need to file a tax return Internal Revenue Service

.jpg)

Tax Guide for the Manufacturing Industry Ryans Uk

2021年2月23日 As there is no legal separation between yourself and your business, the money your business makes is classed as personal income, which you’ll have to pay income tax for instead Corporation tax is paid at a flat rate whereas income tax is progressive, which means that the percentage you pay increases depending on the amount you make2018年2月23日 The repeal of the 1% privilege tax, originally found in NC Gen Stat § 10518751, was nearly prevented by Governor Roy Cooper’s veto of Senate Bill 257 on June 27, 2017Governor Cooper cited budget concerns as his primary reason for vetoing the bill However, the North Carolina Legislature voted on June 28, 2017 to override Governor Cooper’s veto and North Carolina Sales Tax Exemptions for Manufacturers2024年8月31日 Paying taxes is something you might assume you’ll only have to do as an adult But it’s helpful for teens to know what their tax responsibilities are when earning moneyTeens and Income Taxes: Do They Need to File? Investopedia2021年7月23日 Since April 2013, the Statutory Residency Test was introduced to provide definitive guidance on how to determine someone’s tax residency There are three tests in total, but not all three need to be completed The first two are ‘automatic’ tests which means that so long as your status can be confirmed from the first test, you do not proceed to the remaining Do I have to pay UK tax on my foreign income? Ridgefield

.jpg)

Income Tax How to Calculate Pay Income Tax for FY 202425

2024年8月1日 Filing Income Tax Returns According to the Income Tax Act, it is mandatory to file income tax returns if: If your gross total income is over Rs 2,50,000 in a financial year This limit exceeds to Rs 3,00,000 for senior citizens and 2021年12月6日 As a sales tax pro in the manufacturing industry, one of the most important aspects of your job is digging into each state’s definition of manufacturing so you understand how your processes are taxed and you are fully aware of any sales tax exemptions available to your company or your clientsManufacturing Sales Tax Exemptions: Making the Case2024年9月28日 Remember, these are the numbers for if you need to file your income tax — it doesn’t necessarily mean you owe money How the standard deduction impacts whether you have to file If all your earnings come from traditional W2 jobs, then making less than the standard deduction would reduce your taxable income down to zero — meaning you don’t How Much Can You Make and Not Pay Taxes? Keeper2024年7月19日 However, some people may need to pay taxes sooner via estimated tax paymentsThis could occur because you aren't having enough tax withheld on your W4 to cover the taxes incurred from the gain Taxes on Stocks: How They Work, When to Pay NerdWallet

How Much Can a Small Business Make Before Paying

2024年7月26日 You won’t have to pay taxes on your business income if you arrive at a negative number representing a net loss Recommended: Net Present Value: How to Calculate NPV SelfEmployment Tax If your business is not 2024年10月16日 If you earn income as a freelancer or receive certain types of nonwage income, though, you may need to pay what the IRS calls "estimated quarterly taxes" » Jump to 2024 estimated tax payment due Estimated Tax Payments 2024: How They Work, When 2023年10月13日 If you sell physical goods, you’re more than likely required to collect sales tax According to the Tax Foundation, only five states don’t have a statewide sales tax: Alaska, Delaware, Montana, New Hampshire, and Do I need to charge sales tax? A simplified guideThis publication provides information regarding Wisconsin’s sales and use tax as it relates to manufacturers It describes the nature of “manufacturing,” what types of purchases or sales by manufacturers are taxable or exempt, and what a manufacturer must do to comply with the lawPub 203 Sales and Use Tax Information for Manufacturers

.jpg)

As a US citizen, what law requires me to pay income tax?

2018年2月28日 The Internal Revenue Code found at Title 26 of the United States Code Title 26 is the full compilation of all the laws passed by Congress relating to tax liability and every other legal obligation, definition, exemption, exception, etc The Internal Revenue Code is the law that requires people to pay taxes and if you believe the folks who say it's only a legal requirement 2023年1月31日 Do Filipino Freelancers Need To Pay Tax? Yes, freelancers are required to pay income tax regardless if they’re working parttime or fulltime for clients in the Philippines or abroad Homebased workers who make money online (such as web developers, writers, SEO specialists, and graphic designers) are included Freelancers doing business in the Freelance Tax Philippines: A Guide to Paying Taxes as a Self If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limitsIs Social Security Income Taxable? (2025 Update) SmartAsset2022年3月17日 Policymakers do not need to create a bias for manufacturing as Cass suggests—they need to eliminate General Industrial Machinery: 5: 7: has illustrated how US manufacturers face a competitive disadvantage due to the steel tariffs—the prices US manufacturers pay for steel are significantly higher than what Made in America? US Manufacturing Tax Industrial Policy

Tax Information Publication Florida Department of Revenue

%PDF15 %âãÏÓ 201 0 obj > endobj 219 0 obj >/Filter/FlateDecode/ID[F7394EA4FAFF6D535A3>]/Index[201 54]/Info 200 0 R/Length 96/Prev /Root 202 0 2023年4月15日 Their basic pay—as well as overtime pay, holiday pay, night differential pay, and hazard pay—are all taxexempt Meanwhile, MWEs who are business owners or freelancers must file taxes Based on data from the National Wages and Productivity Commission 5 , the daily minimum wage in Metro Manila as of September 2022 is Php 46795 for agricultural workers Income Tax Return Philippines: A Beginner’s Guide To Filing2024年11月8日 Even if your kids are young enough to be your dependents, they may still have to pay taxes In some cases, you may be able to include their income on your tax return; in others, they'll have to file their own tax return At What Income Does a Minor Have to File an 2022年5月10日 You’ll complete a separate form for your sole proprietorship taxes, Schedule C, which you file with your personal income tax form, Form 1040Sole Proprietorship Taxes: Everything You Need to Know

.jpg)

New 2024 Thailand Income Tax Regulations: You Now

“Starting January 1, 2024, a Thai tax resident who brings foreignearned income into Thailand must pay Thailand income tax” This is a big change to Thai income tax regulations because expats never had to pay Thai income tax on foreign Do you need help making a decision? Take a look at our buying guide 28 companies the first domestic manufacturer of automatic laser carving machine The swing frame grinding machines PS 350/500/600 are designed for grinding of large work piecesGrinding cutting machine, Grinding cutoff machine All industrial 2024年9月3日 If your total income is less than 25 lakhs, then you do not need to pay any income tax under the old tax regime Budget 202324 makes the new tax regime a default regime According to the new tax regime, a tax rebate of up to 3 lakhs is applicable Beyond this limit, you are liable to pay income tax according to your salary slabHow to Calculate Income Tax on Salary with Examples?2022年6月15日 All other income is charged at a flat rate of 20 percent There are no local income taxes in China What Exemptions Apply to Foreigners? If you have been in China for fewer than 90 days and you are employed by a foreign organization you are exempt from paying taxes; any income earned in China that isn’t paid by your employer’s Chinese branch is not Personal Income Tax for Foreigners in China (2022) ExpatDen

.jpg)

Tennessee Sales Tax Exemption for Manufacturing sales and use tax

2019年11月20日 The second option is for Tennessee manufacturers to bypass the state’s approval and fill out a Streamlined Sales Tax SSTGB Form F0003 “Streamlined Sales and Use Tax Agreement Certificate of Exemption” That form can be sent directly to the manufacturer’s vendors to avoid sales taxes being charged on tax exempt items2024年7月24日 You are liable to pay income tax if you earn more than: For the 2025 year of assessment (1 March 2024 – 28 February 2025) – No changes from last year R95 750 if you are younger than 65 years If you are 65 years of age to below 75 years, the tax threshold (ie the amount above which income tax becomes payable) is R148 217Personal Income Tax South African Revenue ServiceThe Louisiana sales tax exemption for manufacturing provides an incentive for manufacturing production in Louisiana by allowing manufacturers to purchase manufacturing machinery and equipment tax exempt [La Rev Stat Ann §47:301(13)(k)(i)] Louisiana defines “machinery and equipment” as “tangible personal property or other property that isLouisiana Sales Tax Exemption for Manufacturing2024年5月20日 You probably have to file a tax return in 2024 if your 2023 gross income was at least $13,850 as a single filer or $27,700 if married filing jointly However, these thresholds can be higher for How Much Do You Have to Make to File Taxes? NerdWallet