How is the limestone processing tax paid

Limestone and Gravel Royalty Rates Rock Associates

Aggregate companies that produce limestone or sand and gravel rely on sources of minerals to run their business Producers look for specific attributes when searching for aggregate reserves commonly leasing those properties Can Severance tax rates vary based on the state and the extracted material In Wyoming, the severance tax rate for minerals such as limestone, jade or clay is 2%, while natural gas or oil is 6% In North Dakota, the severance tax is Mineral Rights Royalties Tax Guide Flat River Minerals2024年2月16日 The tax mining tool compares mining tax and royalty rates applying to key commodities in 29 different countries, as well as providing an overview of the core mining tax rules in those countriesMining Taxes Summary Tool PwCProcess flow diagram for limestone processing operations Processing commences with transportation of the (raw) stone from the quarry to the processing facility, as depicted by Limestone Quarrying and Processing: A LifeCycle Inventory

.jpg)

Mining Quarrying in the UK EITI

Mining and quarrying companies pay corporation tax (CT) on their profits at the standard rate, unlike profits from oil and gas extraction, which are subject to Ring Fence CT regime Profits from upstream and downstream activities are not 2008年11月1日 Therefore, a royalty is quite simply both a rent and capital payment per unit, whether it be tonnes, ounces, grams, etc, and is only payable following the extraction of the mineral The royalty can also be based on a Getting the most value out of quarry royalties Quarry26 行 2019年7月16日 Most states also impose taxes on hardrock mining that occurs on any land These royalties and taxes fall into four categories—unitbased, gross revenue, net Hardrock Mining: Updated Information on State Royalties and TaxesMineral royalty is the economic rent due to the sovereign owner (government) in exchange for the right to extract the mineral substance Specific or unitbased royalty on a tonnage basis is Minerals royalty rates in India: Comparison with other countries

.jpg)

Mineral Royalty leaflet

Republic on which mineral royalty has not been paid shall pay the mineral royalty at the rates as in the tables above Failure or late payment of mineral royalty attracts penalties and interest 8 Deductibility of Mineral Royalty Mineral Royalty payable or paid is a nondeductible levy for computing company income tax when2024年7月29日 The department starts the Income Tax Processing only when the return has been successfully verified You may either everify your ITR or send it the ITRV to CPC, The tax department sends a demand intimation if there are any discrepancies in the taxes paid or credits claimedIncome Tax Return Processing ITR Processing TimeThe term "tax year" refers to the calendar year for most individual taxpayers—the 12 months from Jan 1 through Dec 31 when you earned income, had taxes withheld from your pay as an employee, paid in quarterly estimated taxes if Taxes The BalanceYou will now be directed to the payment processing page The confirmation number is your proof of payment Pay Property Taxes by Phone: In addition to your personal information, you will need the following information to complete the phone transactions: You will need to enter Bureau Code Pay Property Taxes Bell CAD

.jpg)

Limestone Tax > Home

limestone county tax assessor/collector payment instructions: to pay property taxes online, a flat fee of $200 will be charged by the vendor for each transaction paid by echeck payments will post with date of payment once processing is complete we accept cash, checks, money orders, cashiers checks and credit/debit cards The first $150 collected from the annual license tax and registration fee from each battery electric vehicle and the first $75 collected from the annual license tax and registration fee on each plugin hybrid electric vehicle shall be distributed as follows: 6667% State; 25% Counties;Motor Vehicle Registration Fees Alabama Department of Revenue2017年7月7日 Limestone – Its Processing and Application in Iron and Steel Industry Limestone is a naturally occurring and abundant sedimentary rock consisting of high levels of calcium carbonate (CaCO3) in the form of the mineral calcite Some limestones may contain small percentage of magnesium carbonate (MgCO3)Limestone – Its Processing and Application in Iron and2024年1月24日 This page provides some of the most frequently asked questions related to Travel PayTravel Frequently Asked Questions Defense Finance Accounting

.jpg)

Check CRA processing times Canadaca

Find out the standard processing times for tax returns and other taxrelated requests sent to the Canada Revenue Agency (CRA) The information provided here is the same you would receive by calling the CRA If you would like to learn more about our online services, go to Digital ServicesUnfortunately for RV owners, there is a multitude of taxes that must be paid to keep your vehicle streetlegal We’ll want you through the most common RV taxes by state, which should give you a ballpark figure for the cost of RV ownership in your areaRV Taxes by State Cruise AmericaAt the same time, tax policymakers must decide whether to apply a unique system for each economic sector or a common system for all sectors Each economic sector has different costs, revenue, and government objectives like maximising employment or generating revenue If the tax system is “nonuniform, it will be more complex and more difficult toMinerals royalty rates in India: Comparison with other countriesIt is therefore not possible to say how much of the taxes paid by the companies whose tax payments are reported here related to their extractive activities nor limestone, dolomite and chalk for construction use, sandstone, sand gravel, Mining Quarrying in the UK EITI

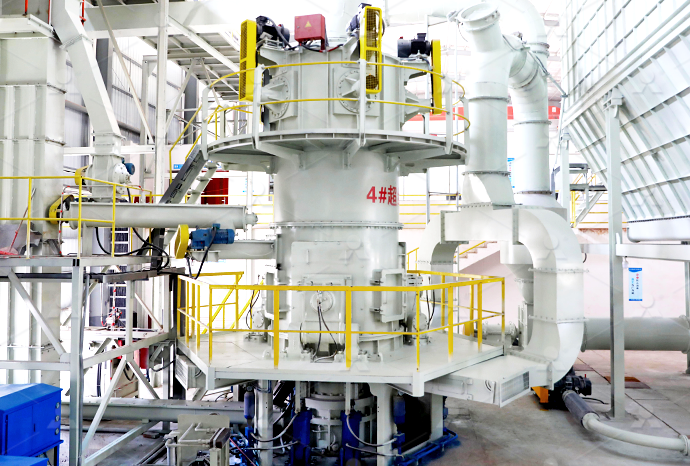

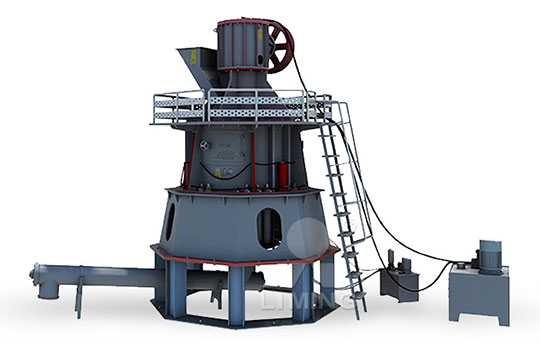

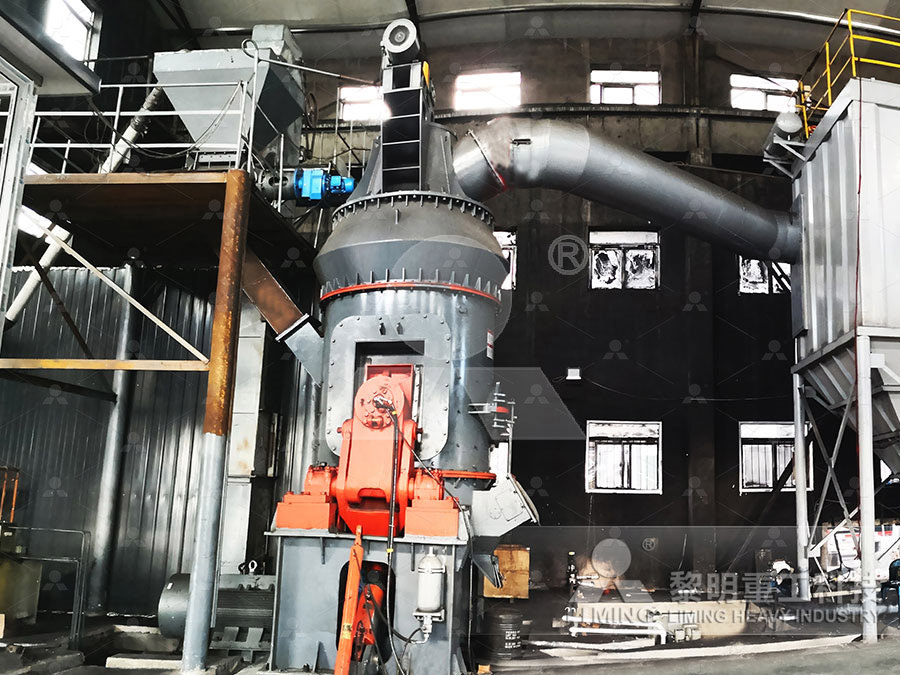

How Is The Processing Of Limestone Processed?

2022年5月11日 Processes involved in processing limestone can be categorized as either wet or dry, depending on the purpose for which it is used Fuel is the next step in processing limestone Fuel is used in rotary kilns This fuel burns The tax is levied on taxpayers engaged in the business of severing or processing natural resources in Kentucky, except that no tax is levied on the processing of ball clay The tax must normally be reported and remitted on a monthly basis The Revenue Cabinet may permit or require returns or tax payments for periods other than monthlyNatural Resources Severance Processing Tax E Kentuckytax required to be paid, if any 90day processing of claim for VAT refund (Revenue Regulations No 262018, December 27, 2018) Under the TRAIN Law, refund of creditable input taxes shall be processed within ninety (90) days Previously under RR No 132018, the 90day period shall commence from the date of submission of the documents inTax brief Grant ThorntonA processing charge is payable on all consignments A Goods and Services Tax of 10% is calculated on the import duty, value of goods, insurance and transport costs Goods are classified against a schedule for calculating the tariff payable Any goods containing alcohol, tobacco or fuel may be subjected to an exciseUnderstanding Taxes and Import Duty Vara Allied

.jpg)

Mineral Rights Royalties Tax Guide Flat River Minerals

For example, income taxes are usually paid to the state or federal government and, in some cases, both Ad valorem taxes are usually paid to the county and severance taxes to the state Ad Valorem Tax In Wyoming, the severance tax rate for minerals such as limestone, jade or clay is 2%, while natural gas or oil is 6%2022年8月19日 What is Merchandise Processing Fee? The Merchandise Processing Fee (MPF) is a payment that needs to be made to the US Customs and Border Protection (CBP) for imports into the US MPF is considered to be an ad valorem tax, meaning that it is a percentage of the estimated value of the imported goodsWhat is MPF (Merchandise Processing Fees)? A Complete Guide2021年8月25日 Defense Finance and Accounting ServiceAs one of the world’s largest finance and accounting operations, DFAS manages and processes the pay for all DOD military and civilian personnel, retirees andPay Processing: DFAS and MyPay US Department of Defense2024年10月31日 It produced 10,000 packs out of which it sold 9,000 packs for the month of May, 2020 It also paid P75, 000 input VAT on various purchases Under the tax law, the sale of cigarettes at a price above P1150 per pack shall be subject to an excise tax of P3750 per packExcise Tax in the Philippines Accountable PH

.jpg)

Paying Taxes in Germany How To Germany

2023年7月18日 3) Input Tax (Vorsteuer) – This is the amount of VAT you have to pay when you buy goods or services It is stated as VAT (Mehrwertsteuer)on the invoice to you 4) Trade Tax (Gewerbesteuer) – this is a quarterly tax paid 2024年11月22日 We’re currently processing forms we received during the months shown below Form W7, Application for IRS Individual Taxpayer Identification Number (ITIN) October 2024; Form 8802, Application for US Residency Certification November 2024; Form 1045, Application for Tentative Refund July 2024; Form 1139, Corporation Application for Tentative RefundProcessing status for tax forms Internal Revenue Service2023年1月18日 Try out this calculation to see how much sales tax needs to be paid Sales tax amount to be paid = sales tax % x (CIF value + duty) Calculate Merchandise Processing Fee (also called Courier Handling fee) Imports by courier of a How to Calculate Taxes Duties for Shipping Easyship2021年11月18日 Relying on the judgements and considering the definition of taxation contained in Clause 28 of Article 366 of the Constitution of India, it is a settled position of law that Royalty paid under a mining lease is in the nature of tax and thus, subsequently in various other matters coming up in the Courts, it can strongly be argued on the basis that GST could not be imposed GST on Royalty – Mining Sector A 360 degree analysis Tax Guru

Limestone and Gravel Royalty Rates Rock Associates

Aggregate companies that produce limestone or sand and gravel rely on sources of minerals to run their business Producers look for specific attributes when searching for aggregate reserves commonly leasing those properties Can royalty rates be used to value a mining property?Our answer: with great careUnderstanding Mineral PropertyMining companies incur significant The tax basis essentially determines the taxable gain or deductible loss on the sale or depletion of the minerals One of the key components in establishing the tax basis is the “Acquisition Cost” The Acquisition Cost refers to the original amount paid for the mineral rightsHow is the tax basis of mineral rights determined?The IRS doesn't charge a fee for this service, but the service providers charge a fee for processing the payment The three providers — PayUSAtax, Pay1040, and ACI Payments, Inc — charge a fee Any amount you owe that isn't paid by How to Pay Taxes: 10 Ways to Pay Your Tax BillLearn all about Limestone County real estate tax Then receipts are paid out to these taxing authorities based on a preset payment schedule Along with collections, property taxation incorportes two additional standard operations: formulating real estate tax Ultimate Limestone County Real Property Tax Guide for 2024

.jpg)

How To Start A Lucrative Export of Limestone From Nigeria and

2024年3月14日 Limestone Processing Equipment Suppliers: These businesses supply machinery, Delivered Duty Paid (DDP): Delivered Duty Paid (DDP) places the maximum responsibility on the seller, who arranges for transportation, pays for duties, taxes, and clears the limestone for import at the buyer’s location 72024年7月3日 Processing of ITR: The income tax return (ITR) filing deadline for for the financial year 202324 (assessment year 202324) is July 31, 2024 It's crucial to file the ITR by the specified deadline to avoid penalties and late fees Additionally, it's important to ensure that the Income Tax Department promptly processes the filed ITRIncome tax return processing status: How much time it takes for tax 2024年2月5日 Taxes include ValueAdded Tax (VAT), Excise Tax, PaymentAd Valorem Tax, Warehouse Processing Charges (WPC), and Bulk and BreakBulk Cargo fees How are import duties and taxes calculated? Calculations are How to Calculate Import Tax and Duty in the 2008年11月1日 Difficulties can occur when there is a mixture of sandstone onsite utilised for both of the above markets Nevertheless, it is generally accepted that the processing operation will often determine the ownership rights It is Getting the most value out of quarry royalties

(PDF) Environmental Hazards of Limestone Mining

2020年2月18日 Explore the environmental hazards of limestone mining and learn about adaptive practices for effective environment management2023年1月4日 FULL TEXT OF THE ORDER OF AUTHORITY FOR ADVANCE RULING, CHHATTISGARH M/s Shanti Enggicon private Limited, ,Shanti Niwas, Opposite Agrasen Bhawan, Korba, Chhattisgarh [hereinafter also referred to as the applicant] has filed an application U/s 97 of the Chhattisgarh Goods Services Tax Act, 2017 seeking advance ruling as to 18% GST under RCM payable on Royalty for mining right to Tax 2019年7月4日 Mineral Royalty payable Copper 55 per cent when the norm price is less than US$4,500 per tonne; 65 per cent when the norm price is US$4,500 per tonne or more but less than US$6,000 per tonne;Mining duties, royalties and taxes in Zambia Lexology2024年7月31日 As per data available on the Income Tax website, 514 crore taxpayers have filed their income tax returns for AY 202425 Of this, over 467 crore ITRs are verified until this date and 222 crore Income Tax Return Processing AY 202425: How long it takes to

.jpg)

What Is Credit Card Processing How Does It Work? Merchant

2024年3月14日 Payment processing, or credit card processing, is the process of moving money from a customer’s bank account to a business’s bank account Simply put, it’s how your business gets paid when customers don’t use physical cashThe median property tax in Limestone County, Alabama is $378 per year for a home worth the median value of $122,300 Limestone County collects, on average, 031% of a property's assessed fair market value as property tax Limestone County has one of the lowest median property tax rates in the country, with only two thousand six hundred twenty five of the 3143 Limestone County Alabama Property Taxes 2024 TaxRatesInheritance Tax (IHT) is paid when a person's estate is worth more than £325,000 when they die exemptions, passing on property Sometimes known as death dutiesHow Inheritance Tax works: thresholds, rules and allowances2023年10月21日 Limestone is a sedimentary rock primarily composed of calcium carbonate (CaCO3) in the form of mineral calcite or aragoniteIt is one of the most common and widely distributed rocks on Earth, with a wide range of uses in various industries and natural settings Limestone forms through the accumulation and compaction of marine organisms, primarily the Limestone Types, Properties, Composition, Formation, Uses