Intangible assets of gypsum mining enterprises

.jpg)

Accounting for intangibles: a critical review Emerald Insight

2024年2月8日 According to the definitions provided by the IFRS and US GAAP, intangible assets lack physical substance but meet the definition of an asset – that is, they must be a We looked at their reporting in many of the key areas addressed by the IASB Steering Committee: accounting for exploration costs and mine development, the amortisation of capitalised costs, Financial Reporting in the Global Mining Industry IAS PlusSome exploration and evaluation assets are treated as intangible (eg drilling rights), whereas others are tangible (eg vehicles and drilling rigs) To the extent that a tangible asset is Mineral Resources Exploration for and Evaluation of IFRS2023年6月15日 Figure BCG 42 includes a list of intangible assets by major category and identifies whether the asset would typically meet the contractuallegal criterion or the 43 Types of identifiable intangible assets Viewpoint

Accounting for intangible assets: suggested solutions

2021年9月7日 Drawing on relevant research, we evaluate solutions for intangible asset accounting that contrast with balance sheet recognition, and we compare these with current In my discussion below, I focus on three areas: (1) single project vs portfolios, (2) internally generated vs purchased assets and (3) measurement after recognition 2 Single project vs Discussion of ‘Accounting for intangible assets: suggested solutions2024年10月1日 FinTech significantly contributes to greening mining enterprises by improving resource efficiency Enterprise characteristics, size, and regional finance levels leads to Sustainable utilization of mining resources: Exploring the impact of 2011年9月1日 We identified key dimensions through which two intangible assets (IAs), organisational and network capital, are enhanced in MNEs and contribute to their Intangible assets as drivers of innovation: Empirical evidence on

Accounting Standard (AS) 26 Intangible Assets Contents

An intangible asset can be clearly distinguished from goodwill if the asset is separable An asset is separable if the enterprise could rent, sell, exchange or distribute the specific future economic 2024年2月8日 Purpose In 2000, Cañibano et al published a literature review entitled “Accounting for Intangibles: A Literature Review”This paper revisits the conclusions drawn in that paper We also discuss the intervening developments in scholarly research, standard setting and practice over the past 20+ years to outline the future challenges for research into accounting Accounting for intangibles: a critical review Emerald Insight2023年9月18日 Untangling intangibles The framework’s guidelines are centred on four pillars: Strategy: To help enterprises communicate how their intangible assets contribute to their overall corporate strategy; Identification: To recommend how enterprises should categorise intangible assets based on their nature and characteristics, facilitating comparabilityNew framework encourages companies to disclose intangible assets2017年1月1日 One of the problems of sustainable development of mining companies is attracting additional investment To solve it requires access to international capital markets, in this context, enterprises The Prospects of Accounting at Mining Enterprises as a Factor of

.jpg)

Leveraging the Power of Intangible Assets MIT Sloan

2006年10月1日 1 The termsintangible assets orintangibles refer to any nonphysical assets that can produce economic benefits They cover broad concepts such asintellectual capital, knowledge assets, human capital andorganizational capital as well as more specific attributes likequality of corporate governance andcustomer loyalty 2 RS Kaplan and DP Norton, “Strategy Maps: 2022年4月26日 An increasing number of new enterprises in the private sector base their business models on the use of data (among other uses) Intangible assets can be differentiated into identifiable and unidentifiable assets Identifiable a company’s ability to conduct data mining with the data asset to create business Recognition and Evaluation of Data as Intangible Assetsintangible assets that are acquired separately or in a business combination (b) the fair value of an intangible asset acquired in a business combination can be measured with sufficient reliability to be recognised separately from goodwill Subsequent expenditureIntangible Assets Hong Kong Institute of Certified Public 2024年10月31日 IAS 38 outlines the accounting requirements for intangible assets, which are nonmonetary assets which are without physical substance and identifiable (either being separable or arising from contractual or other legal rights) Intangible assets meeting the relevant recognition criteria are initially measured at cost, subsequently measured at cost or using the IAS 38 — Intangible Assets

.jpg)

Determinants of intangible assets value: The data mining approach

2012年7月1日 Table 1 lists thirty factors (amongst them, INDUSTRY includes 32 industries) affecting intangible assets, which belong to the six categories Regarding the literature review, these factors are found from diverse domains, such as accounting, finance, management, and marketing However, different domain problems only focus on some of these impact factorsDOI: 101016/jknosys201202007 Corpus ID: ; Determinants of intangible assets value: The data mining approach @article{Tsai2012DeterminantsOI, title={Determinants of intangible assets value: The data mining approach}, author={ChihFong Tsai and YuHsin Lu and David ChiChung Yen}, journal={KnowlDeterminants of intangible assets value: The data mining approachcome under the category of intangible assets acquired by way of government grants Accounting of these types of intangible assets is done on the basis of AS12, Accounting for governmentgrants According to this standard, intangible assets acquired free of charge by way of government grants are to be recognized atAccounting Of Intangible Assets Indian as 26 IOSR Journals2023年11月6日 If you've ever scratched your head trying to understand why certain companies are valued way beyond their physical assets, or why a brand can be worth billions, you're not alone Many students and professionals Decoding Intangible Assets IAS 38: A Comprehensive

.jpg)

43 Types of identifiable intangible assets Viewpoint

2023年6月15日 Figure BCG 42 includes a list of intangible assets by major category and identifies whether the asset would typically meet the contractuallegal criterion or the separability criterion in accordance with ASC 805205511 through ASC 805205545In certain cases, an intangible asset may meet both criteria2021年2月3日 21 Definition and Classification of Intangible Assets From the perspective of accounting, intangible assets refer to identifiable nonmonetary assets owned or controlled by enterprises without physical form []Based on the accounting definition method, Zhao Min (2012) divided intangible assets into three categories, namely, intangible assets of rights, technical The Correlation Between Intangible Assets and BusinessIntangible assets, 31 Tangible assets, 69 (%) Decomposition of corporate value in Japan (Nikkei 225) (2015) Intangible assets, 84 Tangible assets, 16 (%) Decomposition of corporate value in US(SP 500) (2015) Intangible assets, 71 Tangible assets, 29 (%) Decomposition of corporate value in European (SP Europe 350) (2015 Section 3 Intangible assets and economic growth 経済産業省Intangibles Assets Nonfinancial assets recognised by an entity under Ind AS may include, tangible fixed assets such as Property, Plant and Equipment (PPE), investment property and intangible assets such as technology, brands, etc This chapter includes a discussion on key clarifications on theTangibles and Intangibles Assets KPMG

.jpg)

16 Types of Intangible Assets Each Explained in Brief eFM

2023年3月30日 Convertibility – Current Assets and Fixed Assets; Physical Existence – Tangible Assets and Intangible Assets; Usage – Operating Assets and Nonoperating Assets; To learn more about the types of assets, refer to the article – Meaning and Different Types of Assets This article will focus on understanding the meaning and types of Intangible Assets2021年7月1日 Hightech enterprises are knowledge and technologyintensive economic entities These entities are considered intangible assets and an essential part of the enterprisesEvaluation and Management of Intangible Assets of HighTech Enterprises Intangible assets play an important role in increasing the value of companies The performance of companies increasingly depends on ideas, information, and professional services rather than tangible assets The question of how to accurately measure intangible assets remains a challenge for many scientists This study aims to measure intangible assets of 396 companies listed on [PDF] Application of an intangible asset valuation model using 2023年3月1日 Simultaneously, there is a crowdingout effect between intangible and fixed assets in promoting agrifood enterprises’ total factor productivity The findings highlight the importance of the quality and conversion rate of intangible assets, particularly for agrifood enterprises, which are closely related to food security and stabilityThe role of intangible assets in promoting the sustainability of

Intangible assets as drivers of innovation: Empirical evidence

2011年9月1日 In the past decade, the study of IAs has received increasing attention by scholars from the management and accounting science, recognising that immaterial assets yield critical returns to firms, as they represent a major source of value creation 2 Whilst the accounting literature has mostly elaborated on the issue of external financial reporting of intangible assets, 2019年8月17日 Intangible assets are becoming increasingly important to firms However, the question of how firms can realize the full potential of intangible assets remains We propose that corporate social responsibility (CSR) can help a company create value from intangible assets for two reasons First, firms invest in CSR to increase employee loyalty, which in turn help retain Strategic alignment of intangible assets: The role of corporate Intangible Assets The intangible assets of a company are valuable items that do not have a physical existence and cannot be touched Properties of Intangible Assets Intangible assets are nonphysical assets, meaning they lack a Fixed Assets Vs Intangible Assets (with examples2015年5月25日 This study provides evidence that intangible assets have significant impact on cash flows, based on the financial statements (20102013) and industrial, mining, and oilImpact of Intangible Assets on Cash Flows of Publicly

.jpg)

Financial reporting in the mining industry International Financial

International Financial Reporting Standards (IFRS) provide the basis for financial reporting to the capital markets in an increasing number of countries around the2022年5月9日 Knowledge intensive technologies have a serious impact on the economic performance of coal mining enterprises (companies) and the economy of the region as a whole [1] Knowledge intensive technologies as intellectual property objects (IPO) should be recorded on the balance sheet of coal mining enterprises (companies) as intangible assets (IA)Intellectual property as an intangible asset of coal mining enterprisesevaluated separately and, in the case of IAS 38 – Intangible Assets, divided into a research phase (costs initially recognised as expenses) and a development phase (costs initially recognised as an asset if a set of criteria are met, otherwise the costs are expensed as incurred) InDiscussion of ‘Accounting for intangible assets: suggested solutions2001年12月1日 While this is still largely true, evidence suggests that mining companies that astutely manage their intangible assets, can achieve a significant and sustainable marketplace premium over their peers, and therefore far superior shareholder return Mining The reincarnation of dormant “penny dreadful” mining stocks to dot startups Resource Companies Should Mine Their Intangible Assets

GRAP 31 Intangible Assets

Intangible assets with indefinite useful lives 107 110 Review of useful life assessment 109 110 Recoverability of the carrying amount – impairment losses 111 Retirement and disposals 112 117 Disclosure 118 129 General 118 124 Intangible assets measured after recognition using the revaluation model 125 126The costs of intangible assets acquired from nonmonetary assets transaction, debt recombination, government subsides, and merger of enterprises shall be determined respectively according to the Accounting Standard for Business Enterprises No 7 Exchange of nonmonetary assets, Accounting Standard for Business Enterprises No 12 Debt Restructurings, ACCOUNTING STANDARD FOR BUSINESS ENTERPRISES NO 6 INTANGIBLE ASSETS2021年11月16日 Reporting of intangible assets has been an age long issue and a complex hitch largely due to difficulties in obtaining reliable estimates of value for these assets, despite their increasingly (PDF) Discussion of ‘Accounting for intangible assets: suggested 2021年1月13日 In 2006, the “Accounting Standards for Business Enterprises – No 6 Intangible Assets” issued by the Ministry of Finance of China fundamentally changed the accounting method for RD spending The accounting system for Full article: The effect of the revision of intangible

.jpg)

Accounting For Intangible Assets: Complete Guide for

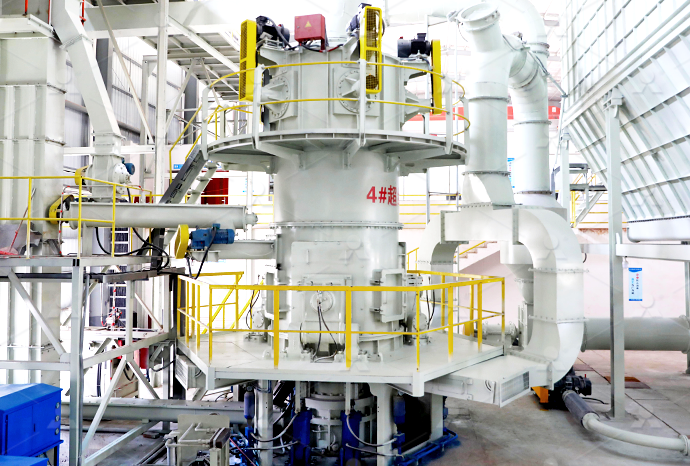

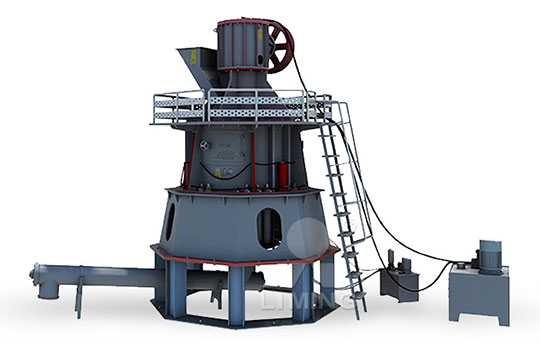

Accounting for intangible assets is tricky for a few different reasons: Identification – Sometimes intangible assets are hard to identify because they have no physical form Value – It can sometimes be difficult to quantify the value of intangible 2020年5月17日 Since 1956, Harrison Gypsum has been a prominent figure in the gypsum mining sector The company has made a name for itself by maintaining a consistent and high level of product quality They operate four The World of Gypsum Mining Digital2010年8月4日 Company XYZ – with few or no recognizable intangibles assets – has 5 billion lbs of copper and gets bought out at 04 per lb – the company would be worth $200,000,00000Intangible Assets Increase Tangible Value to AQM Copper MINING2022年3月18日 Intangible assets have grown in importance, and several authors have focused on the strategic role of IC (Petty and Guthrie, 2000; Kaufmann and Schneider, 2004) IC represents a set of knowledge available to a company; it can be defined as the capital or intellectual assets of a company (Stewart, 2007; Nahapiet and Ghoshal, 1998)Intangible assets management and digital Emerald Insight

A systematic literature review on intangible assets and open

2016年10月14日 Despite the growing interest, Open Innovation (OI) in Intangible Assets (IAs) research is still fragmented and displays a limited contextual focus This paper aims to provide a clearer view of these issues and represents a first step toward filling such research gap A systematic literature review and a synthesis of highquality contributions with a focus on a 2024年4月17日 Intangible assets with finite useful lives are amortised over their useful lives The requirements for the amortisation period and method are set out in paragraphs IAS 389799 and generally align with those in IAS 16 An intangible asset with Depreciation of PPE and Intangibles (IAS 16 / IAS 38 Intangible Assets Contents OBJECTIVE SCOPE Paragraphs 15 DEFINITIONS 618 Intangible Assets 718 Identifiability 1113 Control 1417 Future Economic Benefits 18 RECOGNITION AND INITIAL MEASUREMENT OF AN INTANGIBLE ASSET 1954 Separate Acquisition 2426 Acquisition as Part of an Amalgamation 2732 Acquisition by way of a Government Grant 33Accounting Standard(AS) 26 Ministry Of Corporate Affairs2021年9月23日 treat spending on AI as an investment in a productive asset; set out how such spending would show up in national accounts were it so measured; show how omitting such spending affects measured TFP growth (ii) AI as an intangible asset The discussion above suggests that AI might be thought of as spending on software and databasesArtificial intelligence and productivity: an intangible assets

What Is an Intangible Asset? Investopedia

2024年6月3日 Investopedia / Jessica Olah Types of Intangible Assets Intangible assets are generally considered longterm and their value can increase over time An intangible asset like a brand name can be